If you've ever made a major purchase and you're not a millionaire, you're already familiar with the role that a lengthy, multi-faceted, and pristine credit history plays in bringing about access to new investments. Right or not, it is ultimately a judgment of how well you can be trusted to handle someone else's money; and unless your cousin is a lender, the rules surrounding that judgment can be mystifying.

A person's credit score is the most central measure of economic trustworthiness. An explanation of the algorithm could fill a book, but suffice it to say that someone who has several carefully-managed credit accounts and significant reserves will have a much higher credit score than a person whose house was foreclosed on or (less severely) has a scant history of credit usage.

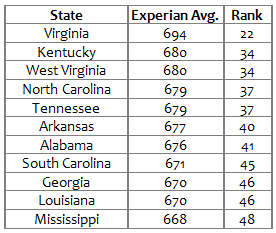

Given other topics I've discussed on this blog, it should come as no surprise that borrowers in the South simply aren't that trustworthy on average. Seven of the ten cities with the worst credit scores are located in the South (The remaining three are in Texas.), and state-level data reveals that most Southern states are ranked in the lowest quartile nationally.

A person's credit score is the most central measure of economic trustworthiness. An explanation of the algorithm could fill a book, but suffice it to say that someone who has several carefully-managed credit accounts and significant reserves will have a much higher credit score than a person whose house was foreclosed on or (less severely) has a scant history of credit usage.

Given other topics I've discussed on this blog, it should come as no surprise that borrowers in the South simply aren't that trustworthy on average. Seven of the ten cities with the worst credit scores are located in the South (The remaining three are in Texas.), and state-level data reveals that most Southern states are ranked in the lowest quartile nationally.

Per Experian, "consumers in the 600-699 range have credit scores that rank higher than 19 percent of U.S consumers. Lenders typically view consumers in this category as higher risk. While many lenders still make credit available, they likely will offer somewhat less favorable terms to compensate for higher default rates in this category."

Though a portion of this can and should be attributed to the recent economic downturn, Mississippi is not Nevada (ranked #50). Nevada was subject to rampant real estate speculation and shady mortgage lending before the bubble burst in 2008. Mississippi has a long-standing history of depriving its poor and black residents from full economic engagement, as do all other Southern states to varying extents.

Though a portion of this can and should be attributed to the recent economic downturn, Mississippi is not Nevada (ranked #50). Nevada was subject to rampant real estate speculation and shady mortgage lending before the bubble burst in 2008. Mississippi has a long-standing history of depriving its poor and black residents from full economic engagement, as do all other Southern states to varying extents.

Given the increasingly urbanized nature of wealth in the South, we can reasonably assume that rural borrowers play a distinct role in the numbers above. To that end, what underlying causes can we target as having played the most significant role in bringing about this current reality? At the risk of oversimplifying a deeply complex regional history, here are four potential causes worth considering:

- PLANTATION-BASED CREDIT SYSTEMS - Into the 20th century, hundreds of thousands of black residents in the rural South had only one source of credit - their white planter bosses. Many sharecroppers had to buy even the most basic items (food, clothes) on credit at the plantation store. Planters also regularly manipulated the "worth" of the work that sharecroppers did in order to fuel a never-ending loop of financial instability. If opting out of this system seems like no-brainer, consider that planters were often friends and had gentlemen's agreements to not hire one another's workers AND that there were few other opportunities in the rural South to get any sort of income.

- LOW TRUST IN BANKS/LENDERS - As fewer and fewer residents of the rural South worked directly in the fields over the course of the 20th century, we can reasonably assume that their trust in financial systems (and that of their children) was quite low, given that the system was stacked against them at every prior turn. This would ultimately contribute to lower rates of banking, especially in the black community.

- FINANCIAL LITERACY - If previous generations in your family have a deep (and well-deserved) mistrust of the credit and banking systems, you will have relatively less knowledge than the average adult re: how to navigate these complicated systems and set yourself up for fruitful pursuits of credit.

- OUTRIGHT RACISM/CLASSISM - Perhaps a no-brainer, but it's logical to assume that amidst a legacy of segregation and caste-based judgment one could find tens of thousands of examples of attempted borrowers who were rejected outright due to their standing in society. It may not have been presented to them in that manner, but there are simply too many first-person accounts of well-to-do whites in power explaining how they took deliberate steps to inhibit the progress of lower classes to believe that this somehow didn't happen.

In my next two entries, I'm going to highlight two players in the lending space that are forging new paths to credit - The Neighborhood Trust and LendUp. I believe the work they're already doing sheds light on potential new paths to building strong credit in the rural South.

RSS Feed

RSS Feed