The Mississippi Economic Policy Center put out the first in a series of reflections on the state of racial equity in the post-March on Washington era. The full policy brief, assembled and distributed by the Economic Policy Institute, includes more in-depth data.

A couple high(low?)lights:

A couple high(low?)lights:

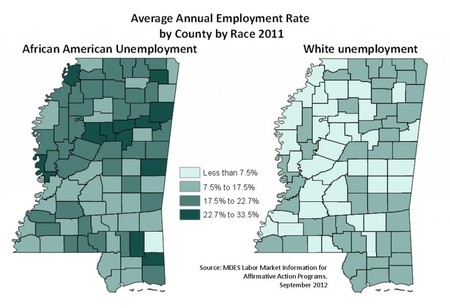

- There are only four counties in the state in which the African American unemployment rate is below 12%

- The greatest percentage point disparity occurred at the peak of unemployment for black Mississippians, in the first quarter of 2010.

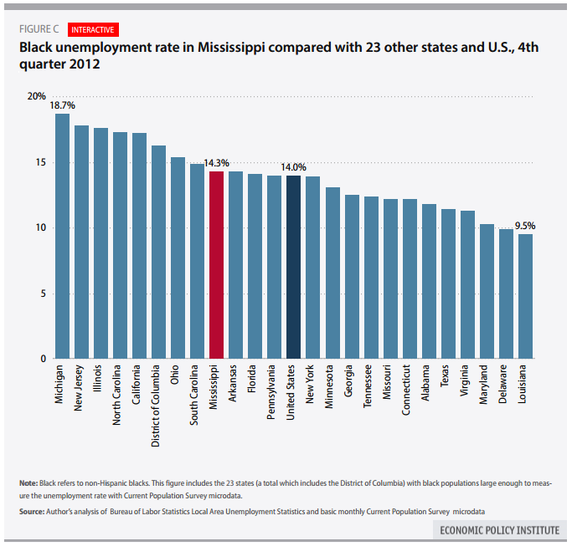

As bad as the disparity is in Mississippi, though, it would be irresponsible to ignore the fact that this is a national problem.

Once again, EPI: Figure C depicts the black unemployment rate in Mississippi compared with the black unemployment rate in each of the other 23 states for which the black population is large enough to measure the unemployment rate with CPS data. It shows that Mississippi has the ninth-highest African American unemployment rate among these states.

Once again, EPI: Figure C depicts the black unemployment rate in Mississippi compared with the black unemployment rate in each of the other 23 states for which the black population is large enough to measure the unemployment rate with CPS data. It shows that Mississippi has the ninth-highest African American unemployment rate among these states.

RSS Feed

RSS Feed